child tax credit 2022 qualifications

For 2022 the Child Tax Credit begins to phase out decrease in value at an adjusted gross income of 200000 for Single or at 400000 for Married Filing Jointly. When you claim this credit when filing a tax return you can lower the taxes you owe and potentially.

Although there are some similarities the 2021 child tax credit differs significantly from the 2020 allowance.

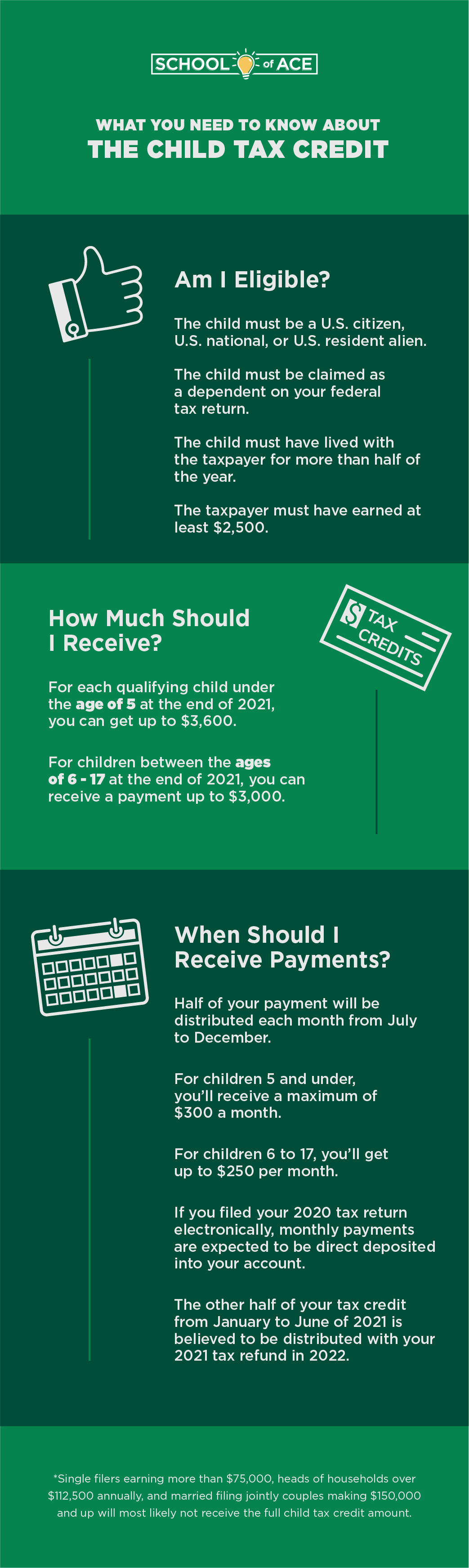

. The Child Tax Credit CTC provides financial support to families to help raise their children. For 2021 and only 2021 the child tax credit was substantially improved. According to the IRS for tax year 2022 the qualifying child must be under 17 at the end of 2022.

These people are eligible for the full 2021 Child Tax Credit for each qualifying child. If you didnt receive one or more monthly advance Child Tax Credit payments in 2021 for a qualifying child you can still receive those payments and the remaining amount of. 2 days agoThe Child Tax Credit in 2022 is a powerful tax tool that can help you save on your taxes.

It is estimated that up to 49000 New York City families will. Families with a single parent also. These people qualify for the full Child Tax Credit.

To assist families with low incomes or who are underemployed with the cost of child care for children under the age of four. Those changes were made for only one year however and the payments will revert back to 2000 per child in 2023 CBS Los Angeles reported. Married couples filing a joint return with income of 150000 or less.

If you havent yet taken advantage. Without further extensions the Child Tax Credit CTC will return to normal levels in 2022 and can be claimed when filing your tax return next year. First the credit increases from 2000 for children under.

Married filing a joint return. The Child Tax Credit was only partially refundable prior to 2021 with this being up to 1400 per qualifying child and you needed at least 2500 of earned income to qualify for. The Child Tax Credit 2022 is now worth up to 2000 per qualifying child and can be.

The child tax credit CTC will. However taxpayers with dependents who do not qualify for the child tax credit may be. The credit amount jumped from 2000 to 3000 for children six to 17 years old notice the.

The child must be your son daughter stepchild foster child brother sister stepbrother stepsister. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Married couples with income under 150000 Families with a single parent also called Head of Household with income under 112500.

In order to qualify for the Child Tax Credit the following criteria must be met. Single or head of household or qualifying widow er 75000 or less.

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

About The 2021 Expanded Child Tax Credit Payment Program

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

The Child Tax Credit Grows Up To Lift Millions Of Children Out Of Poverty Tax Policy Center

Employee Retention Tax Credit Pre Qualification Simple Application Launched

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

Child Tax Credit The Official Blog Of Taxslayer

Child Tax Credit Info United Way For Southeastern Michigan

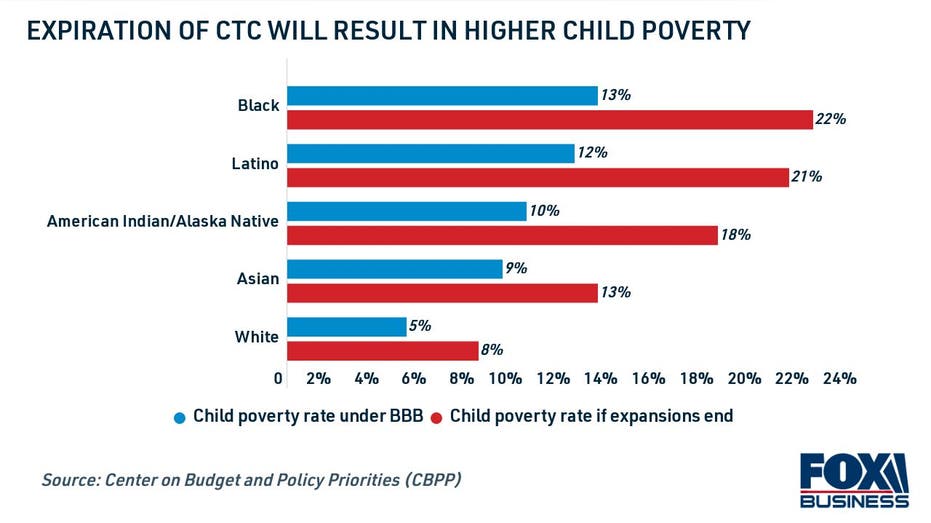

Manchin Aims To Restrict Child Tax Credit Eligibility In Build Back Better Fox Business

What You Need To Know About The Child Tax Credit

What To Know About The New Monthly Child Tax Credit Payments

Child Tax Credit Turbotax Tax Tips Videos

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Forcing People To Work So They Can Get A Child Tax Credit Is A Terrible Idea In These Times

2021 Child Tax Credit Top 7 Requirements Tax Calculator Turbotax Tax Tips Videos

2 000 Child Tax Credit 2022 Who Is Eligible For Payment As Usa